Class inequality has always been a topic society has discussed. Cynthia Tucker makes an interesting point in here column As I See It. To quickly summarize Tucker thinks that $374,327 is a lot of money. That amount represents how much is needed to be part of the 1% tax bracket. She displays here political beliefs as well by attacking Romney by when he said that tax inequality should only be discussed in "in quiet rooms." Lastly she makes a point saying America is not as rich as it used to be. My opinion on the issue is that $374,327 does not make a person rich. $2.5 million and above should be considered the rich. I am not denying that $374,327 is a good sum of cash but for most people to earn that amount they have to work hard. People who make that amount are usually in senior positions of a company having worked there for a minimum of 20 years but started out earning the average wage of $50,000. They had to work hard for this amount so why are people so quick to take away there years of dedication, handwork and passion. Now if we look at people who earn 2.5 mil or above, the American public is literally just giving there cash away. To put it into perspective people who earn so much need to make over $6500 a day. To stereotype them, these people usually do nothing sitting in a chair all day letting the $374,327 do there hardwork for them as they rack in the rewards. These are the people we need to target not the bottom 1%.

Romney never said that it needed to be "discussed" "in quiet rooms." he did however say that the discussion is meant for quiet rooms because there is nothing to talk about making a boring a dull conversation. This is because the rich already get taxed enough so leave them the hell alone. This debate has been going long enough and only the same old idea's are being represented. Let's take a break and wait for new points to arise.

Lastly, America is much richer then it used to be. Just look at the GDP which is adjusted for inflation. It is easy to see that the nation has grown. The per capita GDP is also better. Complaining that factories have shipped to China? Well do you want to work in one. Or do you prefer a desk job that is more comfortable. Make up your mind Tucker. A service based economy is much more peaceful then a manufacturing one. It is silly to say that the America was better when we produced all of our own stuff. Now we get others to make it, add polish and resell it for 1/100 the work but twice the profit. Problem? I don't see one.

Sunday, January 29, 2012

Sunday, January 22, 2012

Project #1

Paul Krugman of the new york times says that the government does not run like a corporation. This is easy too see because a corporations focus is to gain money for there investors. So what is exactly so bad if the government becomes a corporation. They shall make money and it will pay off to the investors or citizens of that nation. He makes an interesting point of saying that money is continuously flowing out of america with no new money coming in. This is because corporations attempt to go after the biggest target market, in this case america has the largest economy so they are everyone's target meaning that american companies and foreign companies both target the american consumer but american companies at the same time do not create exports. Krugman also makes a point that the government cannot slash the budget, "Consider what happens when a business engages in ruthless cost-cutting. From the point of view of the firm’s owners (though not its workers), the more costs that are cut, the better. Any dollars taken off the cost side of the balance sheet are added to the bottom line." This is powerful as when a government tries to save costs people rebel saying they take away services, but in the end this will help them more then the service taken away.

It seems as though the best option for the government is to become business oriented so they can gain much more control of there nation and bring the reins down upon spending as well as increase spending.

It seems as though the best option for the government is to become business oriented so they can gain much more control of there nation and bring the reins down upon spending as well as increase spending.

Sunday, January 8, 2012

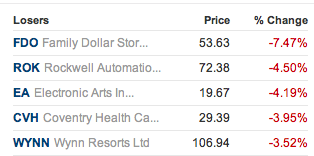

Picture

These are each part of a sector whether they be retail, health care or finance. As you can see they all took a hit and are expected to go down further.

Synthesize- Roader

To summarize Roader posts this it seems that the economy is improving. This is indicated by growth of small caps and office space being leased and built. He also says that this is a prime time to invest. I agree completely as the forecasts for the next 12 months are all green. For more economic indicaters we can looks at china and it's boom as well as us intrests rates which if kept low for the next quarter are garunteed to ensure growth. Banks are also lending more and industries are starting to produce more. This leads to a greater money multiplier and the economy will self correct. My personal thoughts are that this is a good turn of events. I hope soceity will realize there mistake and what lead to the economic crisis and at the same time not repeat it.

What just happened?

According to Roader and his newest column says that the most unexpected companies are leading in profits and earning per share. This typically does not happen but it does occur. Also I would like to make an observation of my own. All the stocks mentioned are smallcap and focused towards growth. Small caps usually lead the way before larger corporations can take hold of the market as they specialize in certain departments. If this is true, it is a very good sign that the economy is picking up it's pace and we can expect a good upcoming quarter.

Roader also in his final moments makes a comment on how the economy jobs reports show that people are gaining more and more jobs. This is especially good as it shows companies are starting to higher and the mmc will be intiated leading to a high industry growth.

Building and the Economy #2

Once again Roader has made an insight way to measure how well the economy is doing in his Article. It seems that things are picking up and that companies are finally starting to expand. Roader shows and easy way to measure this expansion, which is when companies expand they need more space so they lease and buy more buildings for there employees. This is makes perfect and it is happening so we can expect growth this year as corporations are feeling confident and willing to invest and expand. Some information Roader provides is that industrials and food manufacturers are doing best right now. It can be expected that heavy growth will occur and I for one bet my money on it

Misleading Markets #1

According to David Roader and the article he wrote. It seems as though the economy still has a long way to go but things are looking up. He makes an interesting claim that when markets start to pick up everyone says this is an "investors market" just so they will invest into mutual funds. This is problematic because the markets are not really doing that well but they are abusing the power of social media to make everyone think they are alright.

Roader also mentions that investors have no real place to turn to as everything is risky or has not potential to gain. If this is true it is best to short the risky investments and therefore create some gain.

Roader also mentions that investors have no real place to turn to as everything is risky or has not potential to gain. If this is true it is best to short the risky investments and therefore create some gain.

Subscribe to:

Comments (Atom)